What is Nash?

As an entrepreneur, think and let us know how often you have dreamed of getting facilitated with a decentralized monetary transection?

In my opinion, this could make a revolutionary change in the world of finance, trade, and managing digital assets, where the name “nash” has come into play.

Nash has incepted as an organization that allows for decentralized and non-custodial cryptocurrency trading in 2017 and has been working to bring decentralized finance to everyone.

Who Are Behind Nash?

The five open-source blockchain developers Fabio Canesin, Fabian Wahle, Ethan Fast, Thomas Saunders, and Luciano Engel – have come together to form a distributed finance platform using blockchain technology. They built Nash as an integrated financial services platform in which users could invest, trade, and make payments with digital assets.

Founders of “nash” were also behind the City of Zion open-source community, and they continue to develop key infrastructure for the NEO blockchain.

Is Nash User Friendly?

Nash developed extremely user-friendly web and app solutions for their users. The new people who want to know more about their services. Right after getting into nash, all you need to do is scrolling down to get an appropriate idea about their services and watching through their clean web or app UI, which will allow you to get at least a 50% idea about what they are doing here. For a better experience, Users have many preassembled solutions given inside their system with video tutorials.

Fees

Nash requires zero fees while buying or selling bitcoins. But unfortunately, we have seen people are complaining that nash’s exchange processing time is way too high and the user experience of that section is currently under the hood of disliking.

Offers

Nash is offering 50% more commission than competing public programs with the simplest way to help growing businesses. The users can go for the desired scheme out of multiple services depending on their business volume.

Users can get a continuous update of their business just by including them with the active community services. As per security concerns, with Bugcrow, Nash runs a controlled security app. Please ask your account manager to connect you to Bugcrowd if you join.

First Digital Security in EU?

Nash has announced their “Exchange security token (NEX)” in less than a year after their inception by the regulators at the Financial Market Authority (FMA) of Liechtenstein. Right after the approval (30 August 2018), this enabled them to raise more money from their public investors, which has opened much broader implicative sphere for their company and the cryptocurrency market as a whole. It also establishes a framework for several other projects looking to sell tokenized securities on European exchanges, as well as laying the foundation for our upcoming efforts to engage lawfully with governments and regulators.

Nash offers 75% exchange revenue to the token holders, if anyone stake them for 24 months. Moreover, out of 50 million, 19.7 million NEX are already staked. They allow you to get dividends proportionate to the borrower’s volume in various coins. If 50% of the receiver’s volume is in BTC, 50% of your dividends would be in BTC. Nash providers always takes the security concerns at the top as less secure exchange can nullify the whole efforts of a successful and valued exchange.

There are other service providers, who are less likely to comply with the anti-money laundering (AML) laws. But, the fear of not complying with the security compliance, may lead to some sort of harsh consequences for the whole company. So, after considering these real factors, they brought the most value service in terms of security to the investors with the least legal risk. On the same verge of compliance, Kellog Fairbank (Executive Sales Leader for Nash) assured and discussed that they have added partnership with AAVE (An Open Source and Non-Custodial protocol to earn interest on deposits and borrow assets) where anyone can buy AAVE for only 1% fee.

Best rated Fiat on Ramps in the Market?

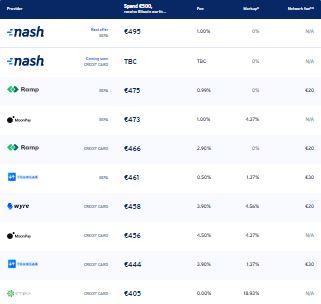

Nash has to offer so much in terms of their services on ramps that you might want to look into their lucrative fiat on ramps and the process is very fast as the delivery faces zero withdrawal locks with very minimal fees of only 1%. For your better understanding, here is the chart, which might give you a proper idea.

Nash’s new business priorities

Nash will continue to provide retail customers with the right way to invest in cryptography while expanding to provide digital banking offerings that incorporate DeFi services seamlessly.

This assessment is guided by the trend in our metrics, and our confidence can deliver advantages over rivals in our fiat ramp and wallet products. While our fiat ramps only assisted USDC purchases by the end of January, they saw consumer growth by 20% a month after they began in September last year. We expect this growth trend to be greatly increased with the coming release of instant payments for many in Europe, new media strategies and funding for various new cryptocurrencies. Nash would have a clear comparative edge in terms of market leading rates, payments as low as 0 percent, instant asset distribution and MPC-secured wallets. Nash policymakers have also started to simplify their services in order to give consumers the resources they need to participate in cryptocurrencies. They will create a number of new features that will be unique to our mobile app.

They intend to support trading a much broader range of cryptocurrencies to and from cash at spot markets by the end of 2021, with at least ten additional commodities on the horizon.

By incorporating direct banking services into our mobile application, such as national currency checking accounts, high-yield savings accounts powered by DeFi, and debit cards that interact with digital assets, they hope to make interactions with the traditional financial world easier.

The newly developed streams of revenue via fiat ramps and banking services will flow directly to NEX stakers as USDC.

Their exchange policy has played an important function that enabled most competitive fiat ramps and Nash link. They have now intended to increase liquidity for major pairs when pursuing professional traders with a tangible amount of business benefits.

Final Thoughts

Nash manages state channels through several blockchains using a fast off-chain matching engine. Users make trades, and the matching engine changes their blockchain balances, which are written to the chain regularly. User balances should only be changed after cryptographic signatures for specific trades have been issued, ensuring that their funds are still under their management.