Cryptocurrency markets today are seeing a touch of recovery after digital asset prices suffered from some significant losses over the past few days. The entire virtual currency economy has consolidated just above the $200 billion mark, after dropping well below this threshold during Saturday evening’s trading sessions. Over the last seven days, each digital asset in the top ten (except for tether) has lost between 10-30 percent in value over the last seven days.

Cryptocurrency Markets Lose up To 30 Percent in a Week

Last week wasn’t the greatest for cryptocurrency markets as a great majority of them have suffered deep losses. Today, on September 9, there’s a bit of recovery and consolidation taking place within a good portion of virtual currency markets. For instance, bitcoin core (BTC) prices dropped to a low of $6,094 last night, bitcoin cash(BCH) slid to $464, and ethereum (ETH) dropped to $187 per coin. But today is a different story as BTC has jumped back to $6,370, BCH $483, and ETH has risen to $202.

The top five cryptocurrency trade volumes today are BTC, USDT, ETH, EOS, and BCH. A large number of traders are focused on ethereum markets as they tumbled this week over 30 percent and ETH/USD shorts (bets against ETH) have reached an all-time high. The digital assets that took the least of the blows this week include BTC, XMR, and XML. Overall there really hasn’t been any horrible cryptocurrency news to justify the sliding prices but there also hasn’t been much positive news either to bring the opposite effect.

Bitcoin Cash (BCH) Market Action

Bitcoin cash (BCH) markets are down 3.9 percent over the last 24 hours and 23 percent over the last seven days. At the time of publication, one BCH is trading for $483 per coin with $325.6 million in daily trade volume. The top exchanges swapping the most bitcoin cash today include Lbank ($80.61M), Coinex ($47M), Okex ($40.16M), Huobi ($37.95M), and Bitforex ($32.61M). The biggest pair traded with bitcoin cash is tether (USDT), capturing 42.6 percent of today’s BCH trades. This is followed by BTC (27.6%), ETH (17.2%), USD (7%), and QC (2.5%). With the fifth highest trade volume today and the fourth largest market capitalization, bitcoin cash has a valuation of around $8.4 billion this Sunday.

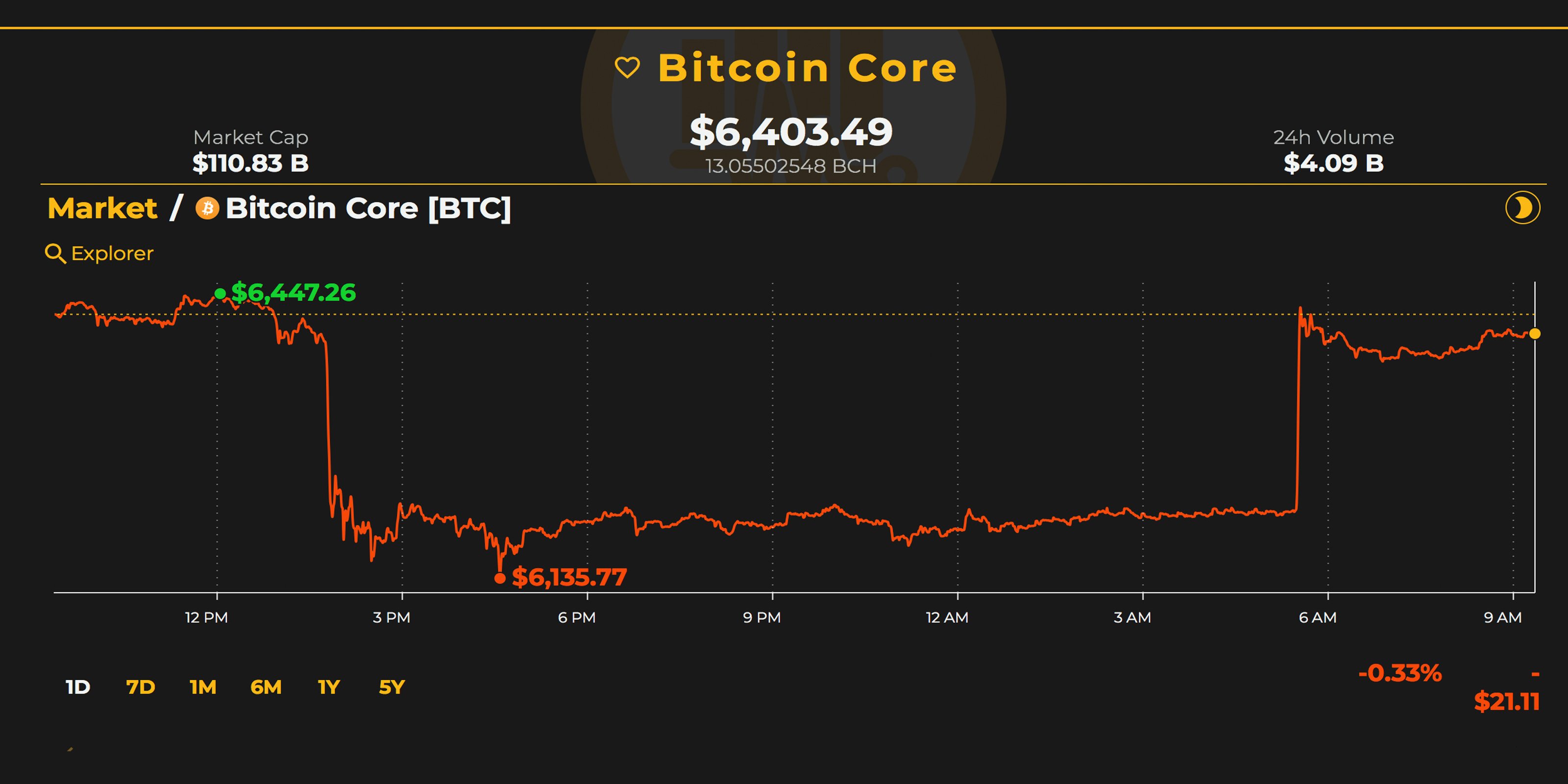

Bitcoin Core (BTC) Market Action

Bitcoin core (BTC) market values have seen losses of around 1.46 percent today and 11.65 percent over the last week. Currently, BTC is being swapped for $6,383 per coin and holds a market valuation of about $110.5 billion. 24-hour trade volume for BTC is around $4 billion and BTC market dominance is around 55 percent at the time of writing. The top five exchanges trading the most BTC today are Bitflyer ($2.11B), Binance ($238.96M), Bitfinex ($148.64M), Bitmart ($139.35M), and Coinex ($80.79M). The top five pairs traded with BTC this Sunday are tether (USDT 56.2%), USD (22.1%), JPY (10.4%), EUR (3.7%), and KRW (3%).

The Verdict: A Thick Veil of Uncertainty and Confusion

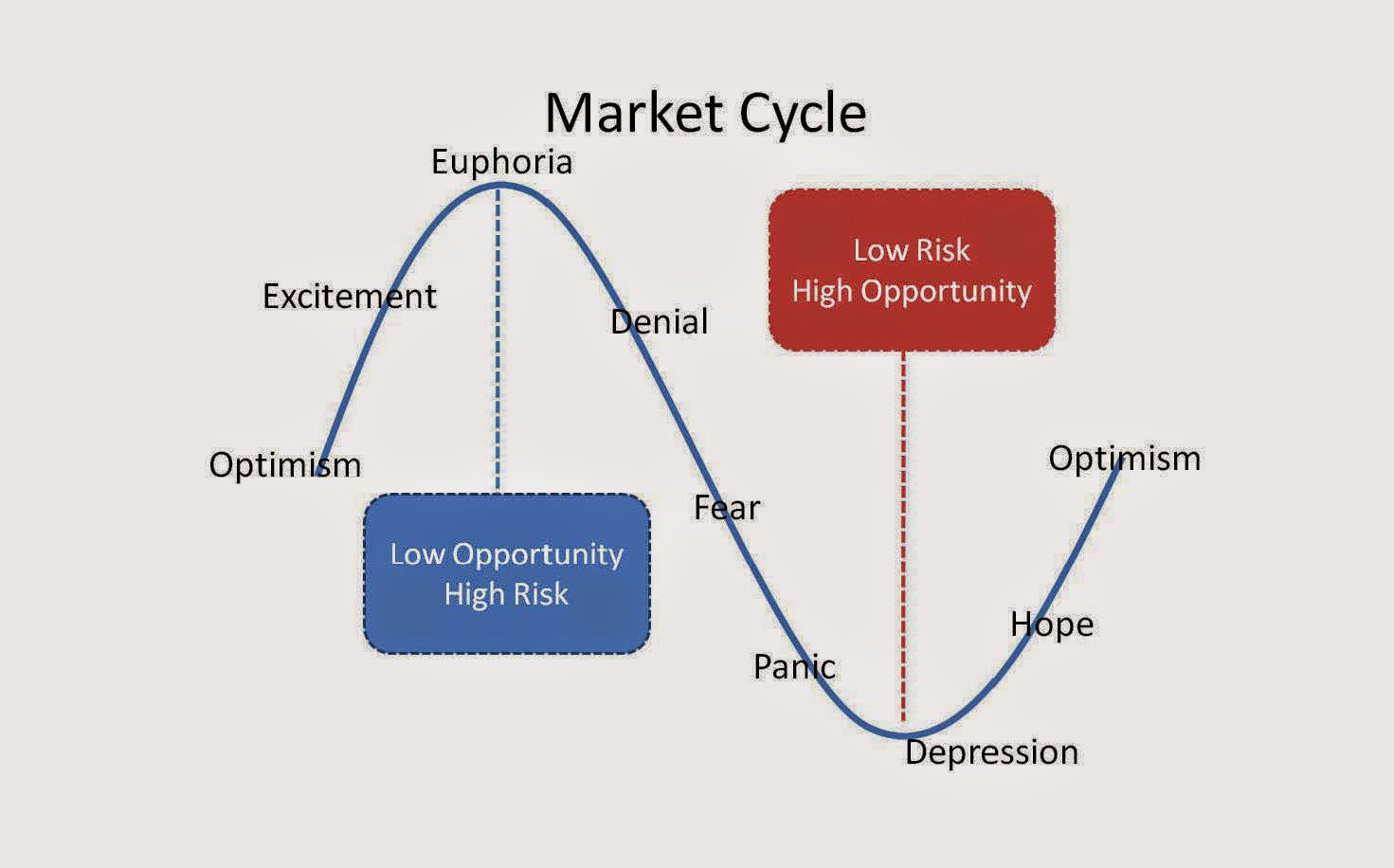

Overall, today is seemingly better than the past 72 hours of trading sessions and many cryptocurrency markets are showing some consolidation. 2018 has been rough for those who didn’t expect a bear market this year as there was a very long cycle of denial and several bear traps over the last nine months. The current verdict this week is a thick veil of uncertainty and confusion.

Many are wondering if we are entering the capitulation market cycle which will then lead to despair or depression, a trend that could cut digital asset values in half from the current vantage point. However, typically after the long accumulation phase and the depression cycle markets should reverse. The problem is traders don’t know if we have already suffered through despair or if we can expect more pain in the near future.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Btynews.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.