As Tuesday rolled around, many traders thought that the worst was yet to come for the market, with critics expecting Bitcoin to chip away at the $5,800 support as the week continued. For those who are unaware, the $5,800 level has been continually cited as a strong line of support, with analysts highlighting previous bounces around this price, along with an amassment of technical indicators.

But to the surprise of some, on Tuesday, the crypto market began a slow recovery of its recently-established year-to-date lows.

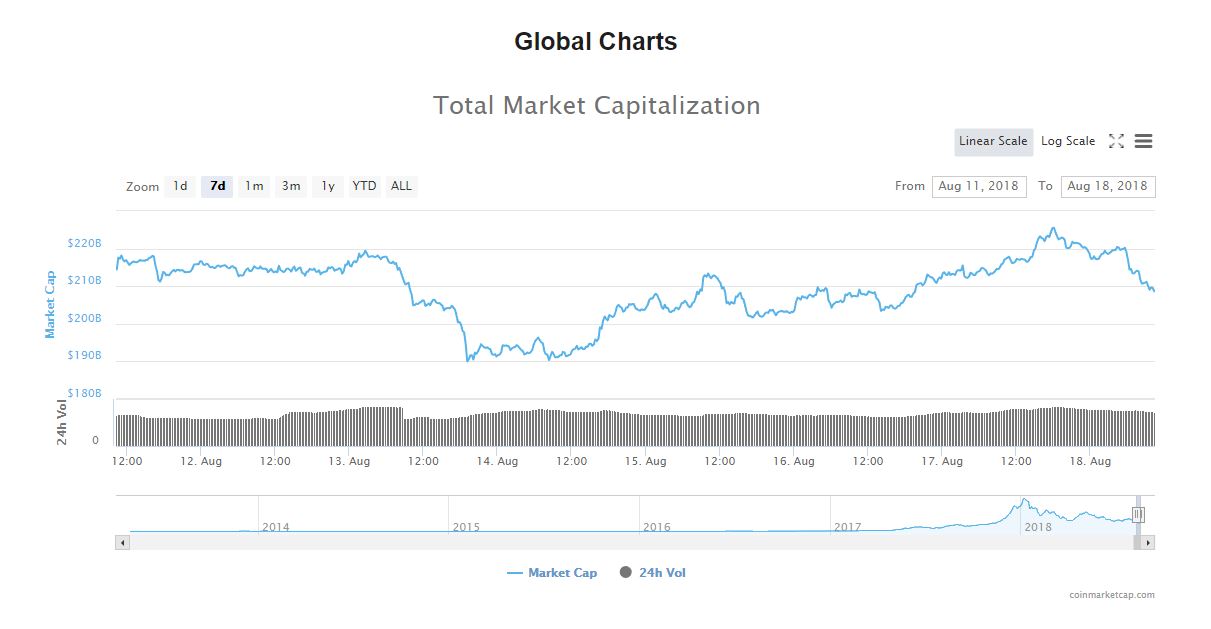

From $190 Billion To $220 Billion — The Market Recovery

The valuation of all cryptocurrencies recovered from a low of $190 billion to $220 billion within a three-day  timespan, with this move restoring faith in an otherwise bearish market. A majority of cryptocurrencies saw strong gains throughout the past three to four days, with Bitcoin taking a cautious move from $5,950 to $6,600 that was backed by consistent volume.

timespan, with this move restoring faith in an otherwise bearish market. A majority of cryptocurrencies saw strong gains throughout the past three to four days, with Bitcoin taking a cautious move from $5,950 to $6,600 that was backed by consistent volume.

But with this move, altcoins have seen an unexpected resurgence, with Bitcoin dominance taking a three percent dive even as the market continued upwards. As reported by Ethereum World News, cryptocurrencies like Nano (NANO), VeChain (VET), and Populous (PPT) all saw staggering gains of 30% or more, which was quickly attributed to the decreasing Bitcoin dominance figures. Traders saw their portfolios turn green overnight, and a slight sense of FOMO (Fear of Missing Out) return to the minds of optimistic traders.

However, some industry leaders aren’t convinced that the bear market is over yet. Susquehanna’s head of digital assets, Bart Smith, recently claimed that this recovery, albeit relatively strong, could just be a “bear market rally.” This sentiment was doubled-down by Dan Nathan, a CNBC trader and Fast Money panelist, who also agreed with what Smith had to say.

While Arthur Hayes, the CEO of BitMEX, still expects Bitcoin to reach and establish a low of $5,000 before eventually continuing to new all-time highs. Moreover, some analysts expect that this is a “dead cat bounce,” where the price(s) of a publicly-traded asset sees a quick recovery after a downtrend, only to fall further at a later date.

“Too Much Of A Good Thing Is A Bad Thing”

Attesting to this bearish sentiment, on Saturday, traders were reminded of the age-old saying — “too much of a good thing is a bad thing” — as the market experienced a slight pullback after the aforementioned recovery.

At the time of writing, Bitcoin is currently down by 2%, with altcoins posting similar losses. It remains to be seen whether the market will continue to head lower in the near future, but according to the traders on CNBC Fast Money, the technicals on Bitcoin’s chart has begun to show signs of weakness. CNBC analyst David Seaburg stated:

“Look at just the charts, without any other knowledge, it looks like its going lower. The technical set-up right now for Bitcoin does not look promising in my eyes.”